Horizon Impact

Corporate Web Presence & Business Representation – Case Study

A professional web presence for Horizon Impact built with Next.js 15.1.3 and TypeScript. The website represents Horizon Impact's business as an impact investment fund manager focused on Southern Africa—showcasing who they are, their focus areas, and their approach—rather than handling investments or lifecycles internally. It serves as their public-facing representative and credibility front.

Project Overview

The Horizon Impact website is a corporate web presence that represents the business as an impact investment fund manager in Southern Africa. Built with Next.js 15.1.3, TypeScript, and Redux Toolkit, it presents the company, their focus on impact investing, and their role in the ecosystem—rather than running deal sourcing, due diligence, or portfolio operations on the site. Investment handling and lifecycle management are internal; the site is their public representative and information hub.

Key Features

Professional web presence showcasing Horizon Impact's business and focus

Secure Authentication

JWT-based authentication and role-based access for authorized areas of the web presence

Company & Focus Overview

Clear presentation of Horizon Impact's business, focus areas, and role in Southern Africa impact investment

Impact & ESG Messaging

Presentation of impact and ESG (Environmental, Social, Governance) focus as part of the company story

Contact & Engagement

Ways for visitors and stakeholders to reach out or engage with the company through the site

Professional Design & UX

Responsive, accessible design that reinforces credibility and supports clear information discovery

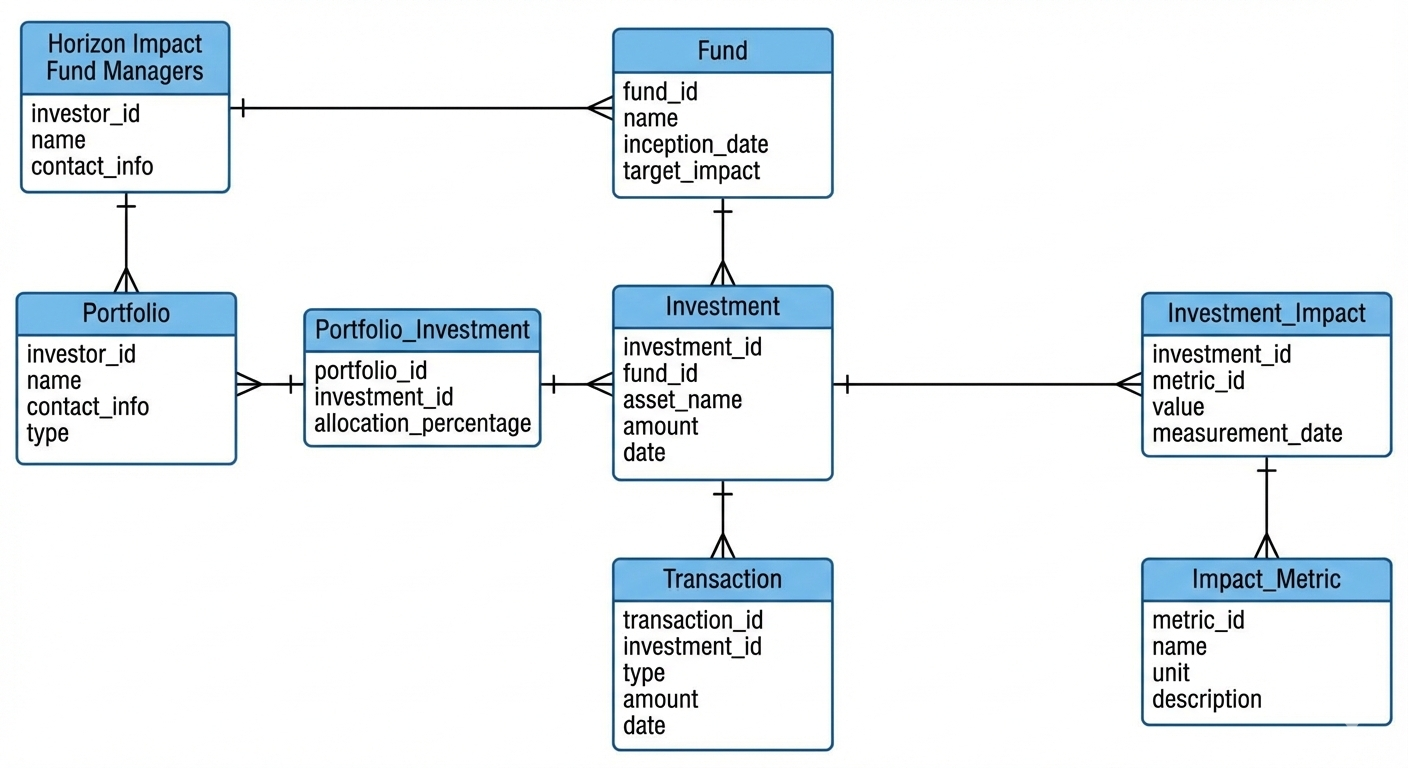

Database Architecture & ERD

Database design supporting the web application's content and features

The database architecture supports the web presence with clear relationships between entities and efficient querying. The ERD below illustrates the schema used by the application for its content, users, and related data.

Entity Relationship Diagram

Core Entities

Users, Funds, Investments, Companies, Impact Metrics

Relationships

Associations supporting the web application

Data Integrity

Prisma ORM with MongoDB optimization

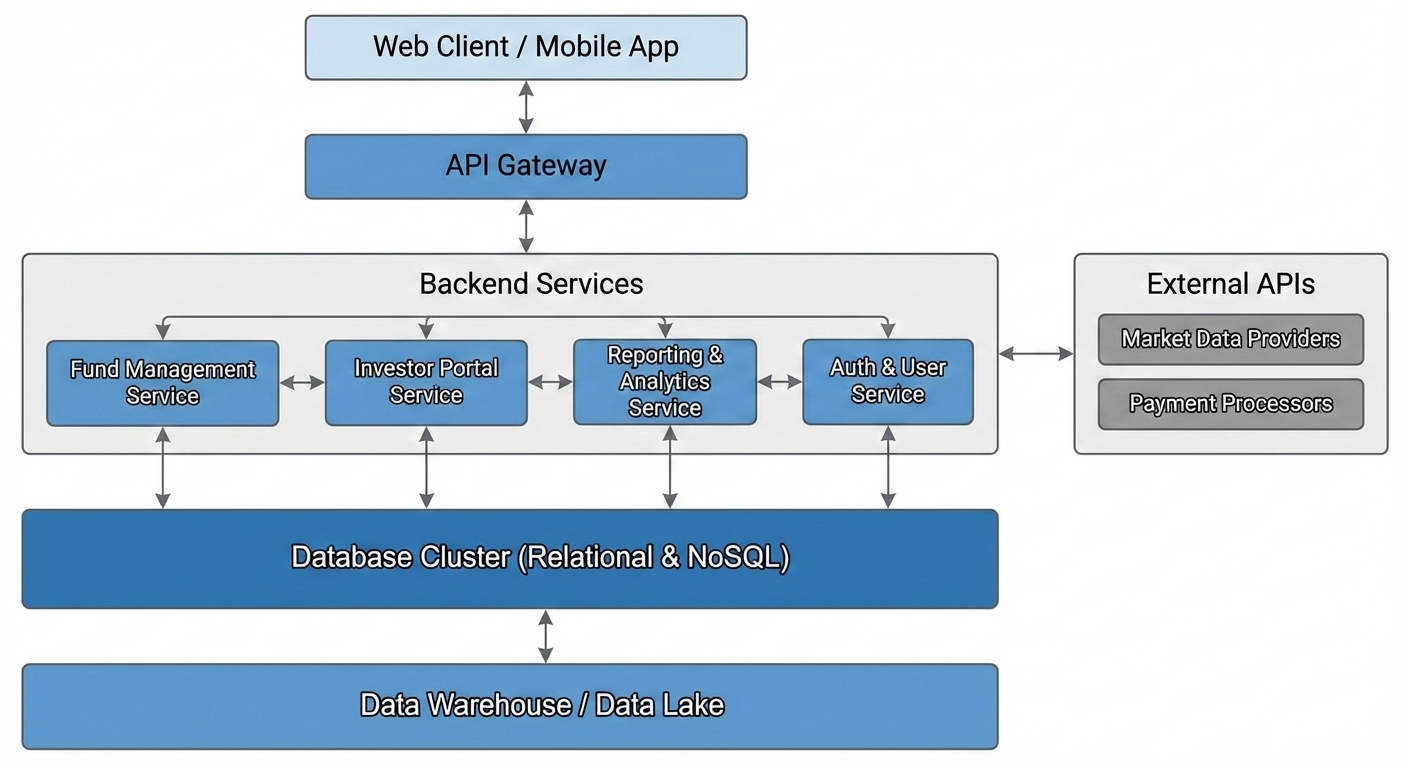

System Architecture

Architecture for a scalable, professional web presence

The system architecture illustrates the application flow for the web presence: Next.js 15.1.3 frontend, API routes, authentication, database integration with Prisma ORM, and services that support the company's digital presence.

Architecture Diagram

Frontend Layer

Next.js 15.1.3, TypeScript, Redux Toolkit

Backend Layer

Next.js API, Prisma ORM, MongoDB

Security & Auth

NextAuth.js, Role-based Access Control

Project Statistics

Database Collections

API Endpoints

React Components

Key Sections

Frontend Architecture

Built with Next.js 15.1.3 App Router and TypeScript for type-safe development. The frontend leverages Redux Toolkit for complex state management, Framer Motion for animations, and Shadcn/ui components with Tailwind CSS for consistent, accessible design.

Backend Architecture

Robust backend architecture with Next.js API routes, Prisma ORM for database management, NextAuth.js for authentication, and MongoDB for flexible data storage. Zod provides runtime type validation for all data operations.

Database Architecture

Data model supporting the web application's content and features

Core Entities

- • Users & Roles

- • Content & Pages

- • Company Data

- • Application State

Content & Display

- • Site Content

- • Focus Areas

- • Messaging & Brand

- • Metadata

Application Logic

- • Auth & Sessions

- • API Data

- • Forms & Contact

- • Feature Flags

Supporting Data

- • ESG / Impact Messaging

- • Company Story

- • Regional Focus

- • Analytics (site use)